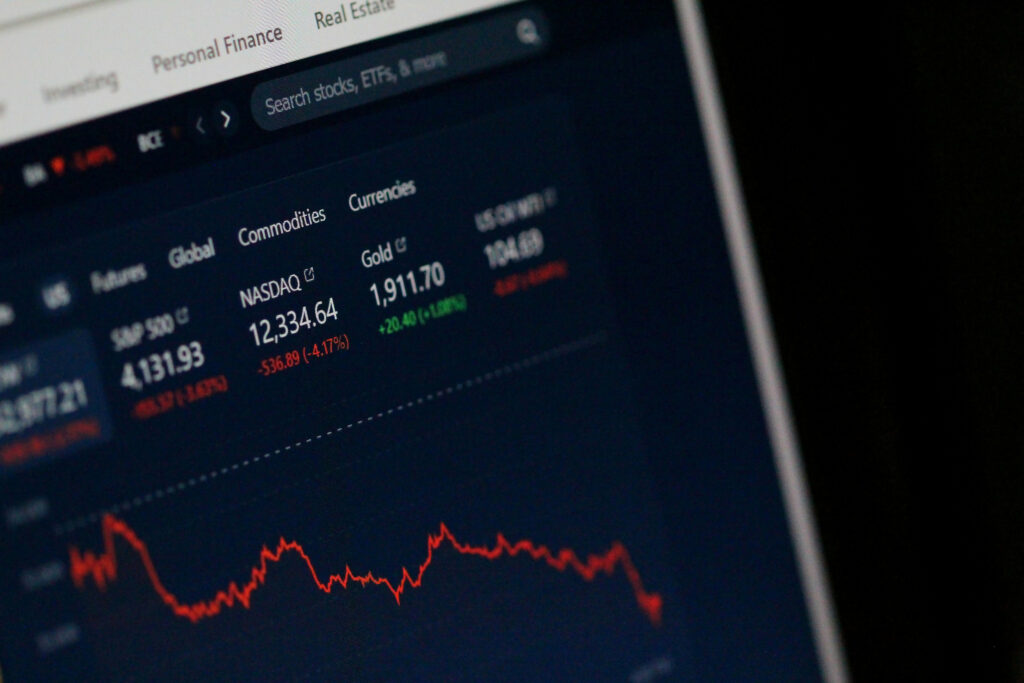

Obligated entities, including financial service providers, spend hundreds of millions of euros annually to carry out “Know Your Customer” (KYC) checks. These procedures are often criticized for excessive bureaucracy and time-consuming questionnaires – and for a reason. Banks frequently collect inaccurate data or duplicate checks already conducted by other institutions, adding unnecessary costs and inefficiencies.

KYCer

Consolidation of Data for KYC Services

At the time of carrying out this project, Accelerate had a wider goal of supporting public/private partnerships, which later evolved to a more narrow focus on unlocking new markets by overcoming regulatory barriers.

Introduction

Problem

When a person opens a new bank account, completes a transaction at a notary or purchases goods on lease, the bank or another obligated entity must carry out a KYC procedure, necessary for compliance with anti-money laundering (AML) and counter-terrorism financing (CFT) laws and regulations.

This due diligence could be in the form of verifying the individual’s identity, understanding the purpose and nature of the business relationships or checking for different risk factors. While many companies are required to perform KYC checks, some sidestep the process due to its complexity or a lack of clear direction on collecting the necessary data.

The crux of the problem lies in the absence of a standardized system, turning each obligated entity into an independent collector of KYC information. This often leads to clients being repeatedly asked for the same information by different banks. Although the data might be available to the state or other banks, it’s generally inaccessible, non-machine-readable, or restricted from sharing by the legal framework.

At the end of the day, duplicating KYC queries is a case of lost efficiency.

Solution

The KYCer application or portal would allow a client to create their own KYC profile, consolidating common data from a range of sources, including state databases.

By integrating government-approved data, a significant portion of the KYC profile will bear the “state-recognized seal,” removing the need for repeated data verification. Beyond state and international databases, this solution facilitates the seamless sharing of verified data between obligated entities.

The client remains at the heart of the solution, deciding with whom they wish to share their KYC profile. The individual can monitor their already shared data and always have the option to withdraw their consent for sharing. Creating and sharing the KYC profile would be a straightforward process, just a click away.

How does the solution differ from existing solutions on the market?

- Individuals can proactively initiate the collection of their KYC data. The data is consolidated and transmitted to obligated entities in a grouped format.

- The profile is always up-to-date, as the data flows into the profile in real time.

- KYC profiles are aimed at using original sources (e.g., data collected/created by the state), but data exchange is also enabled between obligated entities themselves.

- The technical solution would also allow data to be sent back to the state — for example, notifying the population register of the individual’s actual place of residence.

End goal

The solution would streamline KYC processes, cutting down on bureaucratic overhead and reducing the time and financial resources needed for data collection, verification, and transmission. Enhanced information sharing would also boost the quality and reliability of the data. Additionally, automated data management and analysis, such as XBLR GL, would enable more precise risk prevention and detection.

Outcome

The Information System Authority (RIA) eesti.ee platform initially showed interest in creating the technical solution for the product, which led to the development of the project prototype.

As KYC was not a priority area for RIA at that time, a new development partner, RIK (Center for Registers and Information Systems), was discovered. The focus group interviews conducted by RIK confirmed the necessity and interest in such a service/product. Currently, the KYC pilot project is being executed in collaboration with RIK, with plans to integrate this service/product into the business register by 2025.