By the end of 2024 the employer investment solution offered by the financial technology company Grünfin, reached its conclusion in the Accelerate Estonia program. Although the project did not develop into a functioning solution, the analysis and experience gained through mapping the needs of both employees and employers, left behind valuable knowledge to use as building blocks for future legislation.

Grünfin’s idea

43% of Estonia’s working-age population assesses their material security as poor or very poor. According to Statistics Estonia, the household savings rate has dropped from 13% to around 2–3% in recent years. Meanwhile, only 16% of people invest regularly. This led to the question: could employers help increase people’s financial security?

The concept was that employers would make payments on behalf of the employee to an investment account, which the employee could also supplement. For a viable solution, a tax incentive would have been necessary so that employers could make this investment at a reasonable cost. To explore the potential impacts of this solution, Accelerate Estonia commissioned an impact analysis from Ernst & Young (EY) with the aim of assessing whether and how such a model could work, and what value it could bring to employees, employers, and society at large.

What we learned

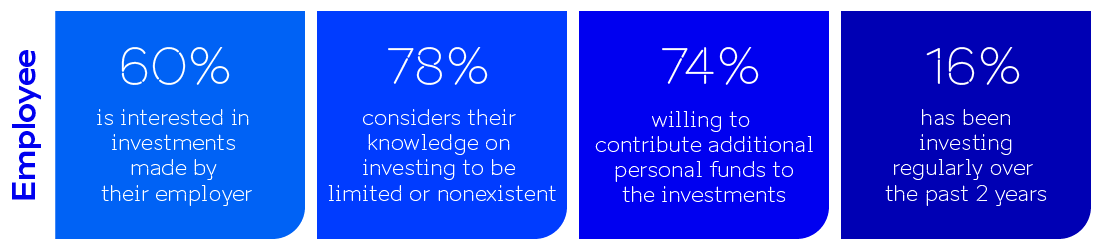

Although Estonians generally have savings, almost half still consider their financial situation as poor. Saving alone is not enough to ensure material security, but investing isn’t a widespread practice. The working-age population has limited knowledge of financial literacy and investing, especially among lower-income groups. Therefore there is a clear need for measures to promote financial literacy and wealth-building. Grünfin’s investment solution can be seen as a practical tool to fill this gap. Currently, employers play a minor role in sharing investment knowledge, according to employees. However, there is a growing expectation that employers should take a more active role in shaping their employees’ financial behaviour.

The analysis showed that widespread adoption of an employer investment solution would increase investment activity. It would both bring in people who have never invested before and increase the total amount invested by interested individuals (mainly in the range of €11–100 monthly), which for almost half of them would mean doubling their total investment amounts. Given that only 16% of the working-age population currently invests while almost half rate their financial situation poorly, boosting investment activity is important. As the total amount of investments grows, a positive impact can also be seen on the savings rate (i.e., the proportion of income that is saved).

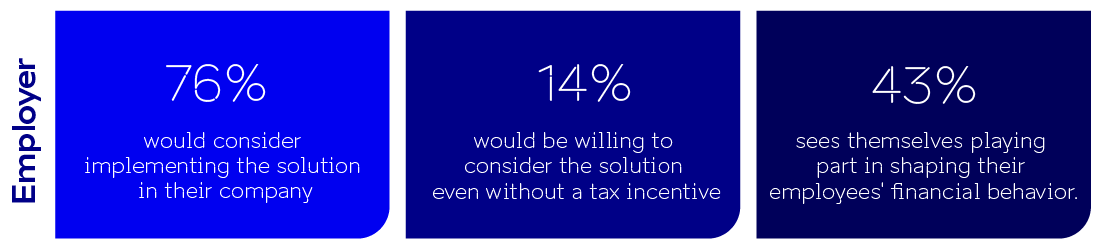

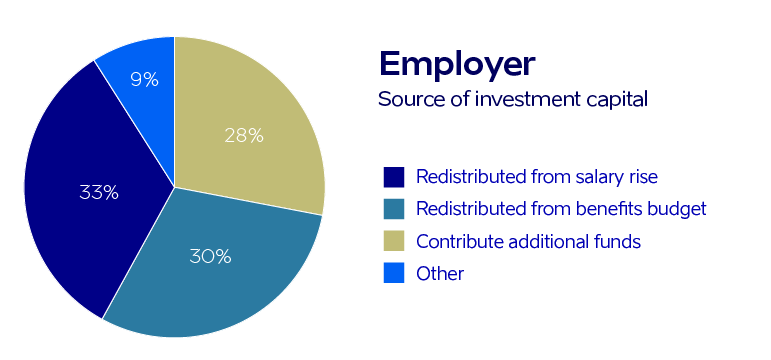

Employee and employer interest in such a solution exists but for employers it largely depends on tax incentives. With the current tax regulations, employer interest is low, and thus the solution has not gained traction nor generated societal impact. If tax benefits were applied to employer contributions, a significant portion of employers would consider adopting the solution, thus positively impacting a large share of the working-age population and bringing broader societal benefits.

From the employer’s perspective, implementing such an investment solution would primarily help foster longer-term employment relationships. Employers emphasized that it must be a long-term program where investments cannot be withdrawn prematurely and that participation should be voluntary for both employer and employee. It’s also crucial to consider employees’ varying risk profiles.

Social Impacts

- The third pension pillar (voluntary pension scheme) is a comparable product but has not gained widespread adoption, potentially leading to financial difficulties during retirement. Consequently, government policy has mainly focused on encouraging broader use of pension investment solutions.Promoting other investment solutions is currently not a state priority, particularly through tax incentives. However, the limited use of employer contributions to the third pension pillar shows that without tax incentives, large-scale adoption of employer investment solutions is unlikely. Medium-term, growing financial reserves through such a solution could reduce the need for early pension withdrawals and strengthen the pension system’s sustainability.

- Although the state has introduced various investment-promoting solutions (like the investment account and third pension pillar), these have not attracted a critical mass of working-age people. Investment accounts are mainly used by wealthier and more financially literate individuals, and the third pension pillar is largely seen as a retirement savings tool — with many people viewing retirement as a distant priority.Major life expenses (buying a home, education, health reasons) occur long before retirement, making more flexible investment solutions necessary.

- Investment knowledge is especially lacking among lower-income groups, who are unlikely to start investing independently. For them, employer-driven solutions would be particularly justified.The primary users of an employer investment solution would likely be individuals earning between €750 and €2,250 net per month. Lower earners would prioritize higher immediate income, while higher earners already tend to manage their own investments — although they also showed interest.

- Lack of knowledge and skills is the second biggest barrier (after lack of free funds) to investing. An employer-driven investment solution could bridge this gap by improving financial literacy and investment skills.

Impact on the State Budget

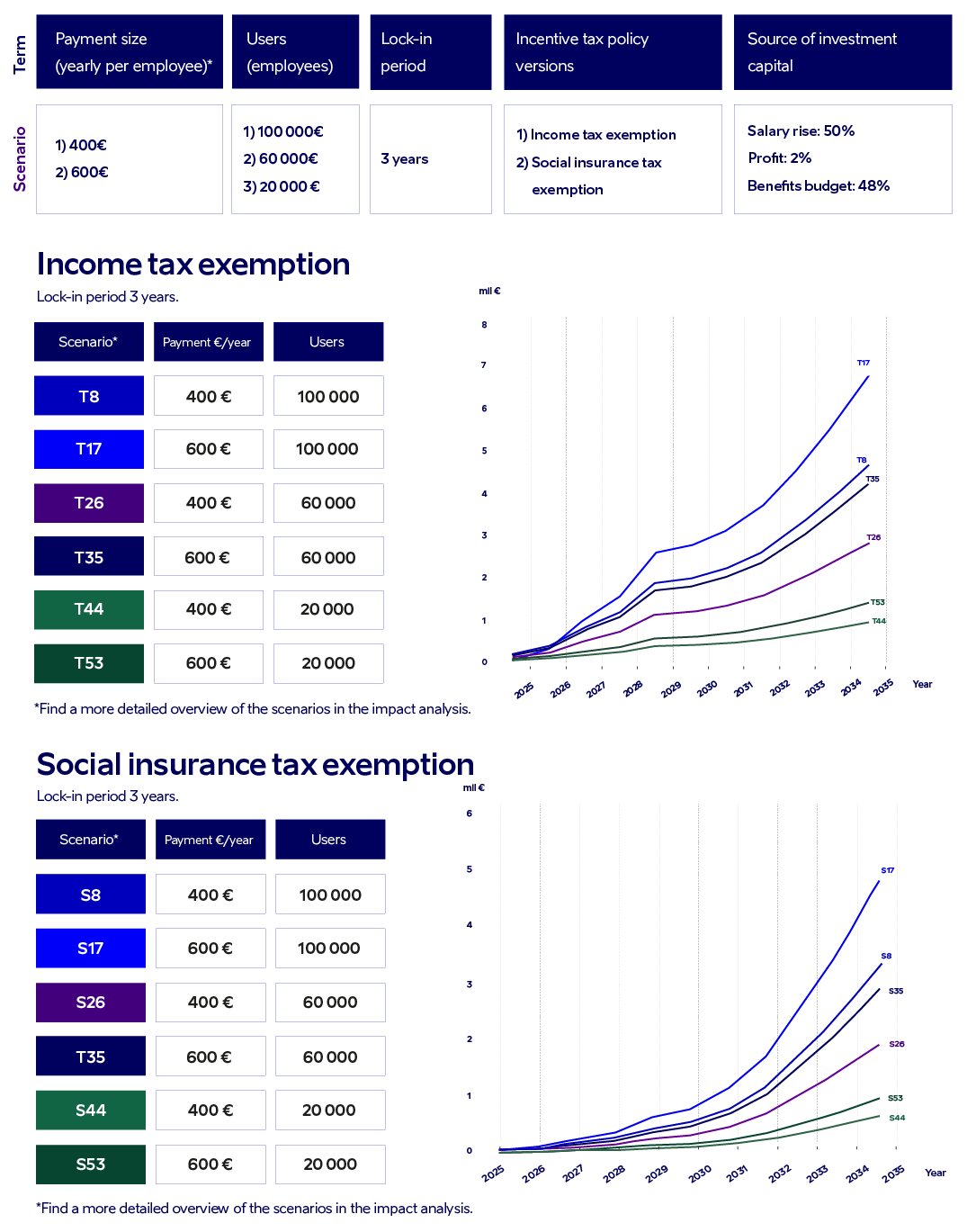

EY analyzed different scenarios regarding employer investments and potential tax incentives:

- If contributions come from salary growth: The government might lose some social and income tax revenue.

- If contributions come from employee benefits budgets or fresh funds: The impact could be neutral or even positive, as the state would collect tax revenue from investments that otherwise wouldn’t happen. Therefore, a realistic scenario is that employers channel fresh funds into investments, which in turn increases the tax base for the government.

- Postponement of capital gains taxes: Longer lock-in periods delay tax payments but ultimately generate new tax income when employees eventually sell investments. This income tax is new revenue for the state, as these investments would not have been made otherwise.

The analysis concluded that with appropriate funding combinations (based on employer surveys), a partial tax incentive (such as income tax exemption) could actually provide additional revenue for the state, as these investments currently do not occur. Thus, there is a viable course of action that could be fiscally neutral or even positive for the state budget, provided the incentive is reasonably limited. The aim of the analysis was to identify scenarios in which the solution could work—and several scenarios were also found where the solution would have a negative impact on the state budget. However, the analysis demonstrated that if the solution and the corresponding legislation are thoughtfully designed, it is possible to create an outcome that benefits the population, employers, and the state alike, while also giving rise to a new financial services market.

Project Outcome

The widespread adoption of an employer investment solution — requiring tax incentives — would boost financial literacy, savings rates, and investment activity among the population, create a new financial services market, and long term, increase state revenues.

Due to not reaching the expected growth rate Grünfin, the project’s private-sector partner, decided to close shop at the end of 2024. At the same time, the impact analysis—with input from both Accelerate Estonia and the Ministry of Finance—was completed. Despite clear data and well-founded recommendations, the proposal—specifically the introduction of a tax incentive—did not gain government support. As both the private-sector partner and policy shift were essential for scaling the solution, the project was concluded under the Accelerate Estonia program.

The detailed impact analysis remains public and is intended as a foundational resource for anyone looking to improve the financial future of Estonian citizens through employer-driven initiatives. Hopefully, these lessons will inspire future innovative solutions to emerge when the political and economic environment is more favorable and aligned.